How Much Will My Building Be Charged for Emissions Under Local Law 97?

Local Law 97 of 2019 was created as part of the Climate Mobilization Act, which has also been called the NYC Green New Deal. Starting from 2024, LL97 will penalize buildings with emissions that exceed a certain limit. To avoid these penalties, you must reduce the emissions of your building below the applicable limit, and this can be done by reducing energy consumption.

In this article we will provide an example of how emissions and penalties are calculated, assuming a 300,000 sf building with an occupancy classification of Business Group B. The building consumes 7,500,000 kWh of electricity per year, and 80,000 therms of natural gas.

1) Calculating the LL97 Emission Limits for a Building

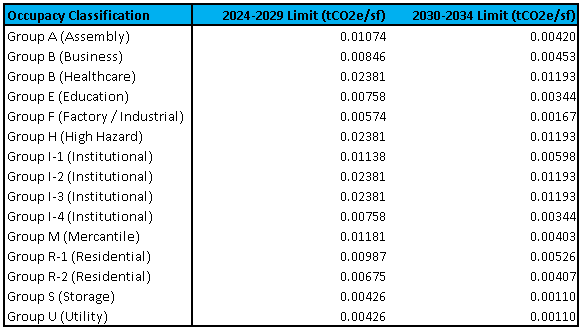

LL97 of 2019 uses different emission limits depending on the occupancy classification, which are summarized in the following table:

In the case of Group B (Business), buildings are subject to a limit of 0.00846 tCO2e/sf for the period 2024-2029, and a limit of 0.00453 tCO2e/sf for the period 2030-2034. If we apply these two values to the 300,000-sf building in our example, we get the following emission limits:

- 2538 tCO2e / year for 2024-2029

- 1359 tCO2e / year for 2030-2034

If the building exceeds these limits, it will be subject to penalties. Also, since the limit is lower for 2030-2034, the penalty also becomes higher unless the building has reduced its emissions by that time.

Emissions are calculated directly based on the usage of energy sources like electricity, natural gas, #2 fuel oil, #4 fuel oil and district steam. Each source has its own emissions factor, and this means that the impact of energy savings varies depending on the specific energy source that is being saved. For example, saving 1,000 gallons of #4 fuel oil has a higher impact on emissions compared with saving 1,000 gallons of #2 fuel oil.

2) Calculating the Current Emissions of the Building

LL97 also includes emissions factors for each energy source, which are summarized in the table below. These apply for all occupancy groups:

- Electricity = 0.000288962 tCO2e / kWh

- Natural gas = 0.00005311 tCO2e / kBtu

- Steam = 0.00004493 tCO2e / kBtu

- #2 fuel oil = 0.00007421 tCO2e / kBtu

- #4 fuel oil = 0.00007529 tCO2e / kBtu

The building in this example is using 7,500,000 kWh of electricity per year, and 80,000 therms (8,000,000 kBtu) of natural gas. This would result in the following emissions:

- Electricity emissions = 2167.22 tCO2e per year

- Natural gas emissions = 424.88 tCO2e per year

- Total emissions = 2592.10 tCO2e per year

This means the 300,000-sf building exceeds its emission limits for both 2024-2029 and 2030-2034. Unless the owner can reduce emissions, penalties will be applied starting from 2024. The building is only slightly above the first limit (2538 tCO2 eq), but the difference with the second limit that applies from 2030 is more drastic (1359 tCO2 eq).

The building exceeds the 2024-2029 limit only by 54.1 tCO2e, but the 2030-2034 limit is exceeded by a larger amount of 1,233.1 tCO2e.

Want to get an estimate for any applicable carbon penalty for your building as a result of NYC Local Law 97?

3) Calculating the LL97 Penalties for the Building

LL97 applies a penalty of $268 for every tCO2e above the limit. The building in this example would be subject to the following penalties unless its emissions are reduced before each respective period:

- 2024-2029 penalty = 54.1 tCO2e x $268/t = $14,498.80 / year

- 2030-2034 penalty = 1,233.1 tCO2e x $268/t = $330,470.80 / year

The penalty for the second period (2030-2034) is around 22 times higher than the penalty for the first period (2024-2029), and this is due to the lower emissions limit. To avoid these penalties, the building owner must reduce emissions below 2538 tCO2e/year by 2024, and below 1,359 tCOe/year by 2030.

The occupancy classification of the building is very important. For example, a 300,000-sf healthcare facility would have a limit of 7,143 tCO2e per year for 2024-2029, and a limit of 3,579 tCO2e per year for 2030-2034. Even if both buildings have the same size, the healthcare occupancy has much higher limits than the business occupancy.

4) Reducing Building Emissions

Since building emissions depend on energy consumption, owners must improve their energy efficiency to meet LL97 and avoid the corresponding penalties. There are many ways to save energy in buildings, and the optimal selection of energy efficiency measures will depend on the needs of each property.

The best recommendation is starting with a professional energy audit, since it will reveal the optimal energy efficiency measures for your case. Ideally, you should start with the measures that have the highest impact on emissions, to get your building below the 2024-2029 limit and avoid the first set of penalties.

Michael Tobias

Michael Tobias, the Founding Principal of NY Engineers, currently leads a team of 150+ MEP/FP engineers and has led over 4,000 projects in the US

Join 15,000+ Fellow Architects and Contractors

Get expert engineering tips straight to your inbox. Subscribe to the NY Engineers Blog below.