3 Factors to Choose the Right Tesla for You: 2022 Buying Guide

Tesla has become a household name in the US, and for many people that is the first brand that comes to mind when electric vehicles are mentioned. With the drastic increase in gasoline and diesel prices in 2022, interest in alternative transportation options such as electric vehicles is growing. Between August 2021 and August 2022, gasoline prices in the US were up by 25.6% while electricity prices increased by 15.8%. This means electric vehicle owners have been impacted less by energy price inflation, especially those who also generate their own power with solar panels.

Considering an EV charging station for your commercial building? Get a professional design.

Here we will discuss three important things to know if you plan to purchase a Tesla car in the US, covering the most popular models, the availability of EV charging stations, and the new tax benefits introduced by the Inflation Reduction Act.

1)EV Sales by State and Top Selling Tesla Models

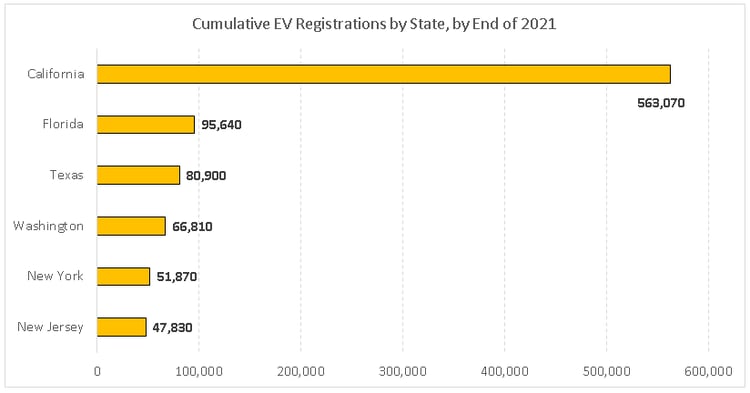

According to data gathered by the US Department of Energy, the number of electric vehicles registered in the country reached 1,019,260 by the end of 2020 and 1,454,480 by the end of 2021. In other words, 2021 was an excellent year for EV sales, with 435,220 new vehicles registered and a year-over-year growth of 42.7%. However, the adoption of EVs has not been distributed evenly throughout the US, and the following six states were leading the way by late 2021:

California alone accounts for over 38% of the EV market in the US, and the top six states have over 900,000 in registered units, representing over 62% of the market.

You can purchase EVs from a wide selection of automakers in the US, and there are many high-quality options, but two Tesla models are currently dominating the market:

- Tesla Model 3: Over 120,000 units sold in 2021

- Tesla Model Y: Over 170,000 units sold in 2021

The Tesla Model 3 is a fully electric 4-door sedan with a range of 272 miles, and there is a Long-Range version that reaches 358 miles. The Manufacturer Suggested Retail Price (MSRP) for the Tesla Model 3 starts at $46,990 according to Electrek, considering a rear-wheel drive version with no upgrades. The Tesla Model Y is a 5-door compact crossover with a range of 244 miles, or 326 miles if you choose the Long-Range version. The MSRP for the Model Y starts at $65,990.

2)Tax Benefits for Tesla EVs in the Inflation Reduction Act

A federal tax credit for electric vehicles was already available before the Inflation Reduction Act passed in August 2022. However, the previous version of the EV tax credit has a major disadvantage: it was only available for 200,000 vehicles per manufacturer, and Tesla quickly reached that mark as you might guess.

The Inflation Reduction Act removed the 200,000-vehicle limit, while introducing a new tax credit for used EVs with only one previous owner. This is great news if you were considering a Tesla car, since the brand qualifies for the tax credit once more. The US Department of Energy has a list of EVs that become eligible for the federal tax credit after the IRA, which includes four models from Tesla:

- Tesla Model 3

- Tesla Model S

- Tesla Model X

- Tesla Model Y

Keep in mind that the limit of 200,000 EVs per manufacturer is still active as of 2022, which means Tesla cars are not eligible for the federal tax credit yet. However, the limit will be removed on January 1, 2023. The EV federal tax credit is officially called the Electric Vehicle (EV) and Fuel Cell Electric Vehicle (FCEV) Tax Credit.

After the changes introduced by the Inflation Reduction Act, a new EV qualifies for a tax credit of up to $7,500, while a used EV with only one previous owner qualifies for $4,000.

- The Act has also made the EV tax credit available for commercial owners - vehicles with a weight below 14,000 pounds qualify for a 30% federal tax credit up to $7,500. This is great news if you are considering Tesla cars as a business purchase.

- The Act also introduced a new requirement that limits the number of eligible models to slightly over 30: only EVs manufactured in the US qualify. This is not a problem for Tesla, since all EVs sold in the US are manufactured locally.

The IRA also introduced domestic manufacturing requirements for the materials and components used by EV batteries, but these will be introduced gradually. The $7,500 tax credit is actually composed of two $3,750 incentives - one for meeting the material sourcing requirements and one for meeting the battery component requirements. The following table summarizes the most important points of this eligibility condition:

|

EV Requirement |

Description |

Phase-In Schedule |

|

Battery materials |

Must be extracted, processed and recycled in North America or countries having active free-trade agreements with the US. |

40% in 2023 50% in 2024 60% in 2025 70% in 2026 80% in 2027 and later |

|

Battery components |

Must be manufactured and assembled in North America. |

50% in 2023 60% in 2024 70% in 2025 80% in 2026 90% in 2027 100% in 2028 and later |

This means EV manufacturers must build domestic supply chains to keep their vehicles eligible for the federal tax credit. However, the IRA is giving them time while providing $2.5 billion in financial incentives for local manufacturing facilities ($500 million are provided through the Defense Production Act).

The IRA also places a price limit of $55,000 for sedan vehicles and $80,000 for SUVs and other larger vehicles. The Tesla Model 3 and Model Y can both qualify based on their starting MSRP, but you may exceed the limit depending on the upgrades added. If you’re considering a used Tesla, the $4,000 tax credit for used EVs is subject to a resale price limit of $25,000.

The Inflation Reduction Act also introduced income limits for EV owners:

- $150,000 for individuals

- $225,000 for heads of households

- $300,000 for joint-filing households

Another excellent change introduced by the Act is being able to transfer the federal tax credit to car dealerships. Previously, you had to purchase an EV at full price and wait until the next tax declaration to claim your federal tax credit. Now, you can transfer the tax incentive to the car dealer in exchange for a point-of-sale discount. This means the new federal tax credit for EVs can be claimed indirectly with no waiting time.

3)Availability of Tesla Superchargers by State

In addition to the financial incentives available, you also need to consider the availability of charging stations if you plan to buy a Tesla car. The US Department of Energy also gathers this data for each state, and the availability of charging stations shows correlation with the number of registered EVs as you might expect.

There are 50,625 EV charging stations throughout the US with a total of 134,880 charging ports, and 25,885 are DC fast charging ports. The following table summarizes the top 5 states with the most charging stations, led by California:

|

State |

EV Charging Stations |

No. of Charging Ports |

DC Fast Charging Ports |

|

California |

14,361 |

41,953 |

7,812 |

|

New York |

3,203 |

8,820 |

1,056 |

|

Florida |

2,708 |

7,262 |

1,523 |

|

Texas |

2,302 |

5,796 |

1,213 |

|

Massachusetts |

2,235 |

5,125 |

537 |

If you’re looking specifically for Tesla superchargers, their company website has an updated list by state and a US map with exact locations. They also provide information about EV charging stations that will become available soon. Tesla superchargers have a power output of up to 250 kW, giving your EV battery up to 200 miles of range in only 15 minutes of recharging time.

Ravindra Ambegaonkar

Ravindra, the Marketing Manager at NY Engineers, holds an MBA from Staffordshire University and has helped us grow as a leading MEP engineering firm in the USA

Join 15,000+ Fellow Architects and Contractors

Get expert engineering tips straight to your inbox. Subscribe to the NY Engineers Blog below.